THANK YOU FOR SUBSCRIBING

Andreas Wenger, General Manager APAC

Andreas Wenger, General Manager APAC“IMTF’s RegTech platform simplifies compliance and release of regulatory requirements for Onboarding & Client Lifecycle Management, KYC/EDD, 3rd-Party Risk Intelligence, Secure Document Management, AML Compliance, and Fraud Prevention,” says Andreas Wenger, general manager, APAC, IMTF. “Our emphasis is on the automation of administrative processes and the management of corporate information and knowledge,” he continues.

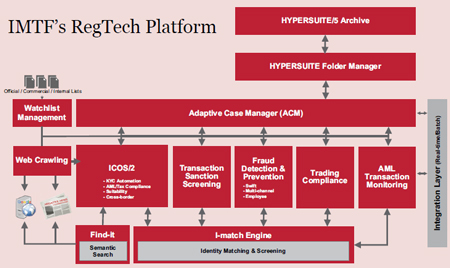

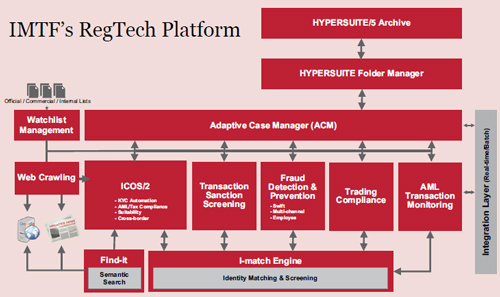

With its modular nature, IMTF’s RegTech platform helps clients improve business agility while automating core processes such as KYC, due diligence, AML transaction monitoring, identity management, and tax compliance. Moreover, IMTF solutions support their clients in streamlining their processes, increasing collaboration by allowing efficient business orchestration with its Adaptive Case Manager. “With their extended know-how in compliance, banking processes, and IT, our experienced specialists assume full project responsibility while implementing each module for our clients, right from detailed business analysis and IT architecture stages to software parameterization, staff training, and go-live follow-ups,” adds Wenger.

The IMTF RegTech platform combines a sophisticated screening technology and a multilingual smart search analysis engine to deliver risk-relevant and contextually useful insights on On individual and corporate clients. The company’s 2019 award-winning innovative ID-matching technology can monitor and detect unusual customer and employee behaviors and match customer names in all languages against lists (external and internal) in real-time.

IMTF’s RegTech platform simplifies compliance and release of regulatory requirements for Onboarding & Client Lifecycle Management, KYC/EDD, 3rd-Party Risk Intelligence, Secure Document Management, Anti-Financial Crime, AML Compliance, and Fraud Prevention

Additionally, IMTF’s multilingual, smart search analysis platform—Find-it—offers a quick, comprehensive, and multilingual search across internal and external data sources. Find-it significantly reduces errors and time to process while increasing the scope and relevance of search results with its advanced combination of person name, risk terms, and synonyms. Find-it significantly reduces the manual processing of search results for self-service-onboarding, KYC review, remediation, due diligence, or employee screening.

Drawing a complete picture of IMTF’s expertise, Wenger recalls an instance when the company assisted a leading Swiss Credit Card provider in resolving their rising number of false positives in the name screening with IMTF’s modular solution. By deploying IMTF’s name screening engine, the provider was able to minimize the number of false positives by 60-80 percent while increasing the quality of hits and adhering to the compliance regulations. Another leading Singaporean bank was able to implement a fully modeled and structured KYC review process, and is currently initiating the rollout of a comprehensive, end-to-end onboarding solution to address a variety of their other processing challenges.

Meeting increasing market demand for their modular platform, IMTF has been honored with many awards including the WealthBriefingAsia recognition in both 2018 and 2019. The company looks forward to expanding its geographical footprint across the emerging APAC markets such as Thailand, Philippines, Indonesia, and Malaysia. From a technological perspective, IMTF aims to stay at the forefront of innovation by continuously developing its modular solutions to address the ever-evolving pain points of its financial clients.

I agree We use cookies on this website to enhance your user experience. By clicking any link on this page you are giving your consent for us to set cookies. More info